Portfolio Design: Return Stacking and Portable Alpha

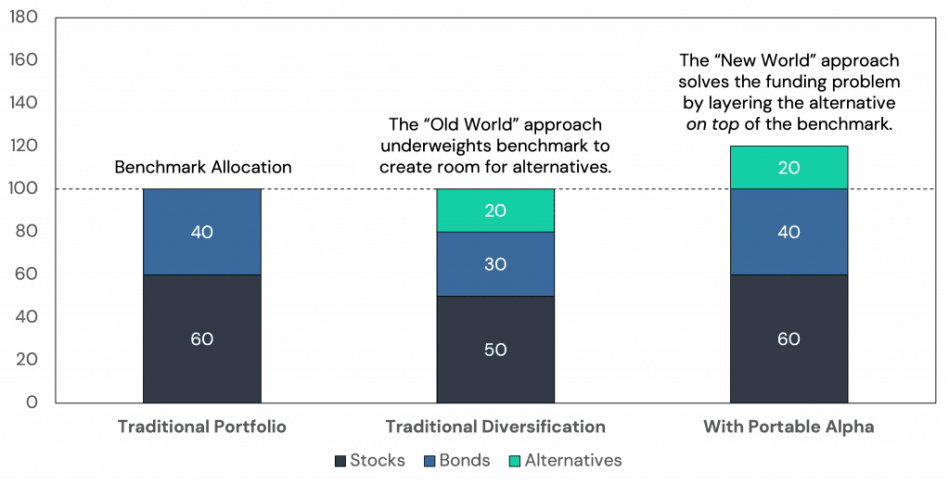

When it comes to portfolio design there are as many approaches as there are practitioners. One effective method is to find a return stream and layer it on top of an inexpensive but consistently average investment. This is called return stacking or portable alpha, in some sense made famous by Jon Glidden’s work in pension management. The example below may be the easiest to understand. Instead of attempting to outperform stocks by selecting the best stocks based on a quantitative screen or qualitative process, why not just buy all the stock represented in an index in what is (incorrectly) called a “passive portfolio”? However, instead of purchasing all of that passive portfolio with cash, we’ll instead use a derivative product like a future or a swap to get the equivalent exposure but with some excess cash (the green and blue step in the image below). Then we’ll take that cash and invest it in another asset that will derive some kind of additional return, like bonds. At the end of the day, you have your “passive portfolio” as a base with your additional return, often called Alpha, on top.

An Example of Portable Alpha in Portfolio Design – an expanded canvas

A great use case example is in the image below also from Returnstacked.com. Let’s look at an example of a 60/40 stock/bond portfolio. It has very favorable risk/return characteristics over time and so it’s often analyzed and compared. In this case, let’s say you want more diversification than what is available in a traditional 60/40 portfolio. Mind you in 2022, the additional diversification from bonds actually detracted from stock performance and provided little diversification benefit. I consider bonds a conditional diversifier for most stock portfolios, rather than something that will always provide diversification. In this case, I’d like to add another asset to my portfolio design. In the example, you’ll see “alternatives” but to continue with 2022 as our example, trend-following provided that positive diversification benefit, so just sub in trend following for alternatives. However, whenever you add diversifiers to a portfolio you have to reduce something else to make space for it. By implementing a return-stacked approach, a portfolio can maintain their original weights to stocks and bonds but still have the alternatives exposure.

Summary

The value of return stacking in portfolio design is to allow for enhanced returns or provide additional diversification depending upon your objectives. Separating beta (the “passive” component) from the alpha can help in understanding portfolio exposures and provide better risk-adjusted returns. These days there are mutual funds and exchange traded funds that offer these solutions and it’s rather simple to understand them and slot them into portfolio design. When it comes to wielding wealth wisely – making sure your investments are operating efficiently and effectively is an important part. For many Americans their savings are not “true savings” but rather investments and that can be OK, but it ought to be done well.

We believe that today more investors (finally) have a viable way to get higher, and higher quality, excess returns into the equity sleeve of their portfolios. – AQR Whitepaper